This website uses cookies to ensure you get the best experience on our website

Read moreKey tax changes for 2022

Now that we’re in the home stretch of tax season, it’s time to take a look at the opportunities available to maximize your tax advantages for 2022. If you’d like to discuss with our team the best tax moves to make in the next few months, the following list of changes is a great place to start.

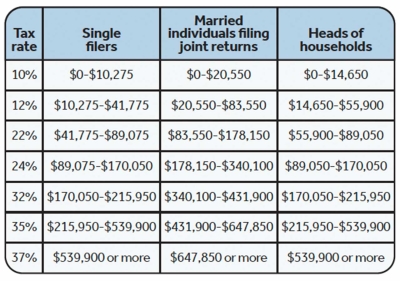

Income tax threshold changes

Income thresholds for federal tax brackets are higher in 2022. This means that a married couple must earn almost $20,000 more to enter the top tax bracket, with the tax rate remaining at 37%.

The basic income tax rates set in the 2017 Tax Cuts and Jobs Act remain the same. The IRS has adjusted other thresholds to reflect inflation, including the standard deduction for married couples, which increased 3.2% to $25,900 this year.

Here’s a breakdown of the new tax bracket income thresholds, representing increases of approximately 3% (to keep things in perspective, the increases were approximately 1% in 2021):

Exemptions, credits and deduction changes

The personal exemption will remain at $0, the same as in 2021. However, the standard deduction has increased to $25,900 for married couples, which is $800 higher than in the current tax year. The standard deduction increased to $12,950, or $400 for single taxpayers.

The maximum Earned Income Tax Credit will also get a boost next year, rising to $6,935 for qualifying taxpayers with at least three children, an increase of more than $200 from the current tax year.

New thresholds for flexible spending accounts (FSAs) and retirement contributions

Employees can put $2,850 in their flexible spending accounts for health expenses, which is an increase of $100 from the 2021 maximum.

The 2022 contribution limit for 401(k), 403(b) and most 457 plans will increase to $20,500 from $19,500 in 2021. IRA contributions remain the same as last year, at $6,000. The same is true for the catch-up contribution for people over 50 years old, which is $1,000.

If you’re a higher-income earner, you may be able to contribute to a Roth IRA in 2022 and receive a benefit because the income phase-out range for taxpayers making contributions to a Roth IRA will be higher, ranging from $129,00 to $144,000 for single taxpayers in 2022. This is an increase from 2021, when the phase-out range for Roth IRAs was $125,000 to $140,000.

Standard mileage rate increase

The standard mileage rate for 2022 is 58.5 cents per mile for business use.

These are some of the highlights of the new tax changes that will impact you in 2022. If you have questions or need assistance with tax planning, please be sure to let our firm know!

Back to issue